|

Much

|

Shortly after receiving Robert McClandlish's letter of May 8, 1985 |

||||||

|

||||||

Above: Shortly after receiving Robert McClandlish's letter of May 8, 1985 |

||||||

|

||||||

Above: Jean O'Connell's instructions to Joanne Barnes. |

||||||

|

||||||

Above: CPA Joanne Barnes's covert instructions to Jean O'Connell |

How much

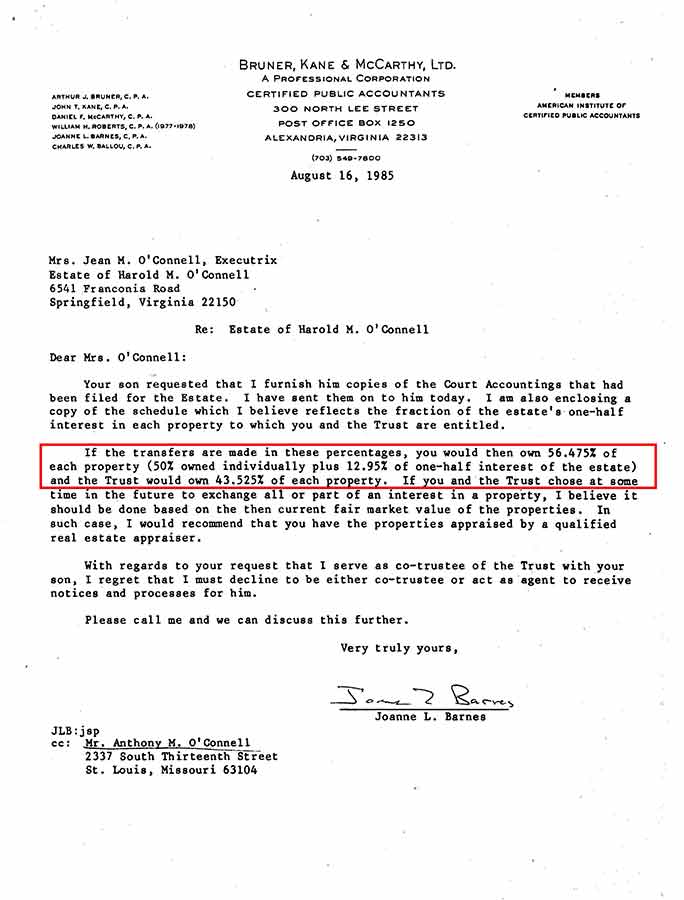

1985.08.16 (Joanne Barnes to Jean O’Connell)

"RE: Estate of Harold M. O'Connell

Dear Mrs. O’Connell:

Your son requested that I furnish him copies of the Court Accountings that had been filed for the Estate. I have sent them on to him today. I am also enclosing a copy of the schedule which I believe reflects the fraction of the estate’s one-half interest in each property to which you and the Trust are entitled. If the transfers are made in these percentages, you would then own 56.475% of each property (50% owned individually plus 12.95% of one-half interest in a property. If you and the Trust chose at some time in the future to exchange all or part of an interest in a property, I believe it should be done based on the then current fair market value of the properties. In such case, I would recommend that you have the properties appraised by a qualified real estate appraiser. With regards to your request that I serve as co-trustee of the Trust with your son, I regret that I must decline to be either co-trustee or act as agent to receive notices and processes for him. Please call me and we can discuss this further.

Very truly yours,

Joanne L. Barnes

Cc: Mr. Anthony M. O’Connell”

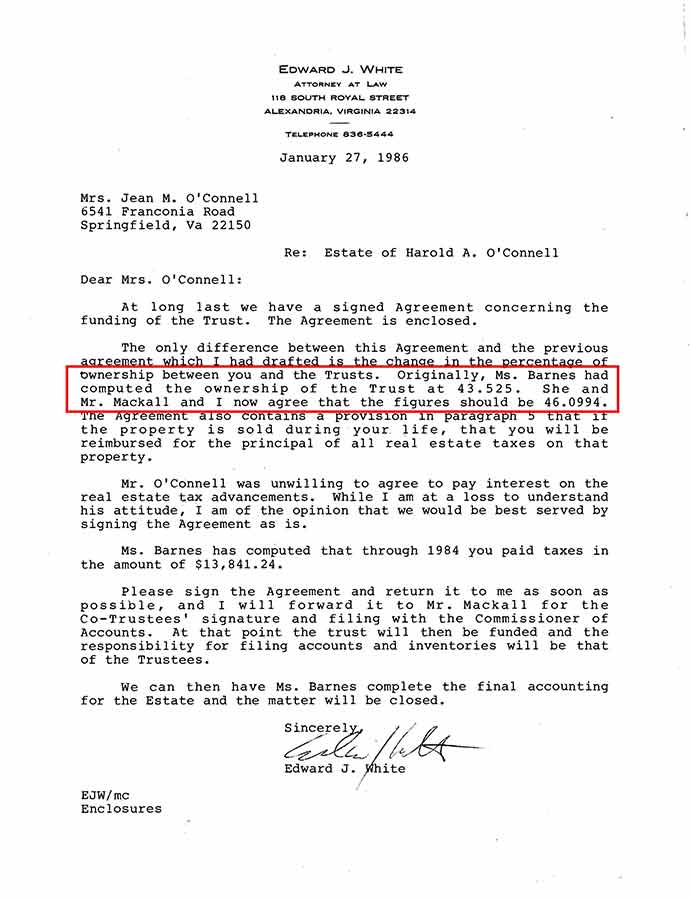

1986.01.27 (Edward White to Jean O'Connell)

"At long last we have a signed Agreement concerning the funding of the Trust. The Agreement is enclosed.

The only difference between this Agreement and the previous agreement which I had drafted is the change in the percentages of ownership between you and the Trusts. Originally, Ms. Barnes had computed the ownership of the Trust at 43.525. She and Mr. Mackall and I now agree that the figures should be 46.0994. The Agreement also contains a provision in paragraph 5 that will be reimbursed for the principal of all real estate taxes on that property.

Mr. O'Connell was unwilling to agree to pay interest on the real estate tax advancements. While I am at a loss to understand his attitude, I am of the opinion that we would be best served by signing the Agreement as is.

Ms. Barnes has computed that through 1984 you paid taxes in the amount of $13,841.24.

Please sign the Agreement and return it to me as soon as possible, and I will forward it to Mr. Mackall for the Co-Trustees signature and filling with the Commissioner of Accounts. At that point the trust will then be funded and the responsibility for filing accounts and inventories will be that of the Trustees.

We can then have Ms. Barnes complete the final accounting for the Estate and the matter will be closed.

Sincerely, Edward J. White"